Many acquisitions fail to achieve their potential as too little consideration is given ahead of the deal of how research, development and technology activities will be integrated. Insufficient due diligence in this area may result in knowledge assets being overvalued and can have a detrimental effect on the company in the longer term.

Steve Bone co-founder of nu Angle says often his company is asked to fix the R&D situation after the merger – once the finance and legal people have left the scene.

“If you inherit two R&D departments with a different clock speed then that can be a real headache for the Chief Technology Officer, who has to make the integration work.” He says.

“Also often the two R&D departments have different cultures – one consumer facing, the other science -focused – or there still may be major technology hurdles to overcome before the product is ready for market and this has not previously been acknowledged.”

A text-book case-study would that of the merger between SmithKline Beecham (SKB) and Glaxo Wellcome’s (GW) R&D, a $182 Billion merger in 2000. From a city viewpoint this appears an ideal integration of multiple functional groups offering diversification within a global business. However, from an R&D perspective the two companies had very different cultures, SKB had a consumer facing market pull culture, but GW a science culture. Under these circumstances, it is very difficult to integrate R&D in order to produce the future value that had been anticipated.

Steve continues, “Where an acquisition has been made to purchase a technology and product pipeline, or to create a new growth platform for the company, then we would recommend that some serious technology management questions need to be answered well before the deal.”

Following years of working with multinational companies helping to define and implement technology strategies and roadmaps, nu Angle has defined the two crucial questions:

• What are the technology benefits for the merger strategically and organisationally?

• Do external and internal technical forces pose a threat or an opportunity to the combined concern?

With an experienced team it is possible to answer these questions very quickly using a best practice framework that nu Angle has developed.

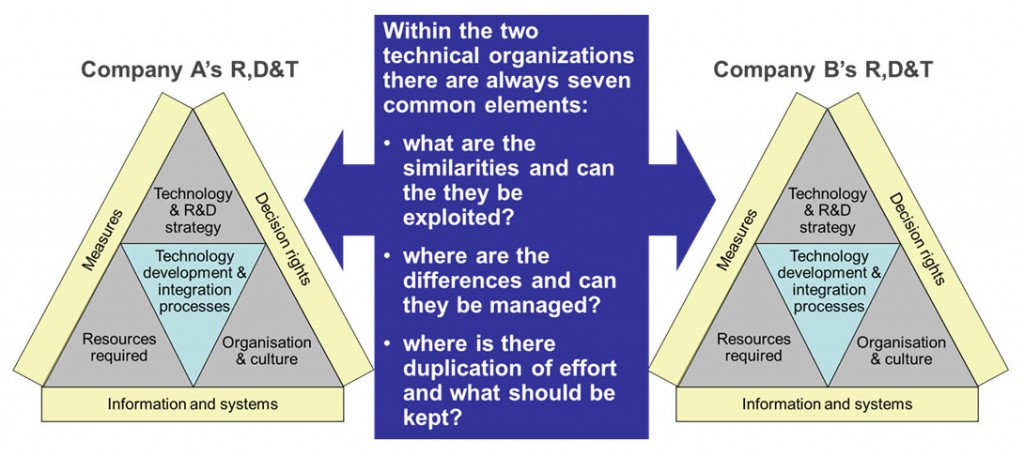

With an experienced team it is possible to answer these questions very quickly using a best practice framework that nu Angle has developed.“We approach the first question within a framework of seven important elements that are common to all R&D departments. This can be used to assess the value of the acquisition from a technology perspective.

“This framework is then used to inform the development of R&D programs after acquisition, also to define optimum structure for the integrated R&D.

“We have found that companies that employ this pre-acquisition approach are better prepared to understand the post integration challenges that can arise and plan for them in advance. This allows the acquired R&D platforms to be successfully integrated. Saving costs and accelerating new product development – if done well.”

Another advantage of this structured R&D pre-assessment is that the company can also detect the cultural issues very early on.

“One company we recently worked with detected very different speeds of work prior to merger. We call this the ‘clock speed in R&D’ and it often results from developing products with very different life-cycles.”

Fast moving technologies that could easily be brought to market by one R&D group prior to merger, may be impossible to achieve in the same timescales post-merger, due to a mismatch in program/project synchronization. Thus difference in ‘clock speed’ will affect the combined speed that new innovations can be delivered by the new R&D department.

“In our case the technology was a specific form of encapsulation in food products – a technology that was on the fastest growth trajectory of the S-Curve. One part of the R&D was slower and could not integrate it fast enough to take advantage of the regulations and Intellectual Property. Fortunately the company had done enough work prior to merger to know about this and to plan accordingly. But if not the market opportunity would have been compromised”

From Steve’s experience a structured R&D pre-assessment will also help to minimize the risk of unpleasant surprises after merger.

“Too often the CTO’s are left to pick up the pieces. The cost of this is rarely factored into the M&A process and can shave millions off the value of the acquisition.”

Further discussion of this issue is contained in this paper Research, Development and Technology assessment during M&A.